What is Velocity Banking

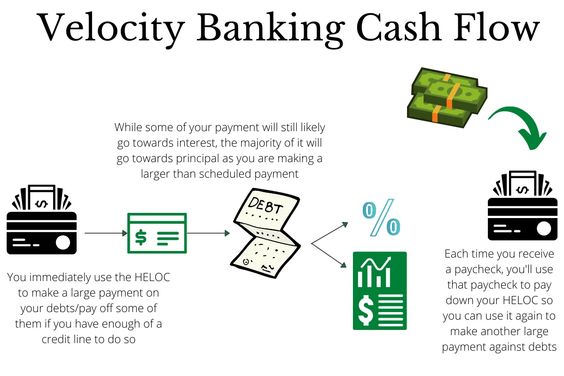

Velocity Banking is a financial strategy that involves using a line of credit, such as a home equity line of credit (HELOC), to accelerate the payoff of debts like mortgages, car loans, or credit card balances. The basic principle behind Velocity Banking is to leverage the available credit to reduce the interest paid on debts and pay them off more quickly.

How Velocity Banking Works

The primary principle behind Velocity Banking revolves around leveraging a line of credit or a home equity line of credit (HELOC) to consolidate and pay off high-interest debts swiftly. By channeling income and expenses through the line of credit, individuals can minimize interest payments and accelerate the payoff timeline. Don’t Miss to Check Out Our Website: Globall Browse

Benefits of Velocity Banking

Velocity Banking offers several compelling advantages for individuals striving to achieve financial independence and debt-free living.

Debt Payoff Acceleration

One of the key benefits of Velocity Banking is its ability to expedite the repayment of outstanding debts. By strategically allocating funds and leveraging available credit lines, individuals can significantly reduce the time it takes to become debt-free.

Interest Savings

Through effective debt consolidation and repayment strategies, Velocity Banking enables individuals to minimize interest payments over the long term. By strategically managing debts, individuals can redirect savings towards wealth-building endeavors.

Improved Cash Flow

Velocity Banking can enhance cash flow by restructuring debt obligations and optimizing financial resources. By reducing monthly debt payments, individuals free up additional funds for savings, investments, and discretionary spending.

Steps to Implement Velocity Banking

Implementing Velocity Banking requires careful planning and execution. Here are the essential steps to initiate the Velocity Banking process:

Assessing Your Finances

Before embarking on Velocity Banking, it is crucial to conduct a comprehensive assessment of your financial situation. This involves analyzing income, expenses, assets, and liabilities to identify areas for improvement and optimization.

Consolidating Debts

Consolidating high-interest debts into a single, low-interest line of credit forms the foundation of Velocity Banking. By consolidating debts, individuals can streamline repayment efforts and minimize interest costs.

Creating a Velocity Banking Strategy

Developing a robust Velocity Banking strategy involves setting clear goals, establishing timelines, and implementing disciplined financial practices. By adhering to a structured plan, individuals can maximize the effectiveness of Velocity Banking and achieve desired outcomes.

Common Misconceptions about Velocity Banking

Despite its merits, Velocity Banking is often subject to misconceptions and misunderstandings.

Misunderstanding Debt Consolidation

Some individuals confuse Velocity Banking with traditional debt consolidation methods. While both approaches aim to reduce debt burdens, Velocity Banking emphasizes leveraging financial resources strategically to accelerate debt repayment.

Risks and Limitations

It is essential to recognize that Velocity Banking entails certain risks and limitations. Without proper financial discipline and planning, individuals may encounter challenges such as overleveraging, liquidity constraints, and potential fluctuations in interest rates.

Success Stories and Testimonials

Numerous individuals have achieved remarkable success through Velocity Banking. Testimonials and success stories serve as compelling evidence of Velocity Banking’s efficacy in achieving financial goals and debt freedom.

Tips for Effective Velocity Banking

To maximize the benefits of Velocity Banking, consider the following tips:

Budgeting and Discipline

Maintain a disciplined approach to budgeting and expense management. By tracking expenditures and prioritizing debt repayment, individuals can stay on course towards financial stability.

Monitoring Your Progress

Regularly monitor your progress and adjust your Velocity Banking strategy as needed. Reviewing financial statements, tracking debt balances, and reassessing goals are essential components of effective Velocity Banking.

Challenges and Pitfalls to Avoid

While Velocity Banking offers significant benefits, it is essential to navigate potential challenges and pitfalls effectively.

Overextending Yourself

Avoid overextending yourself financially by carefully evaluating your borrowing capacity and risk tolerance. Prudent financial decision-making is paramount to mitigating risks associated with Velocity Banking.

Lack of Financial Literacy

Invest in financial education and seek professional guidance to navigate the complexities of Velocity Banking successfully. Enhancing financial literacy empowers individuals to make informed decisions and optimize their financial strategies.

Conclusion

In conclusion, Velocity Banking represents a powerful financial tool for individuals seeking to expedite debt repayment and achieve financial independence. By leveraging strategic financial maneuvers and disciplined practices, individuals can unlock the potential for accelerated wealth accumulation and debt freedom.

FAQs

- Is Velocity Banking suitable for everyone?

- Velocity Banking may be suitable for individuals with stable income streams, disciplined financial habits, and a commitment to debt reduction. It is essential to assess your financial situation and consult with a financial advisor before implementing Velocity Banking.

- What types of debts can be consolidated through Velocity Banking?

- Velocity Banking can be used to consolidate various types of high-interest debts, including credit card balances, personal loans, and student loans. However, it is essential to evaluate the terms and conditions of the line of credit to ensure suitability for debt consolidation purposes.

- How long does it take to see results with Velocity Banking?

- The timeline for achieving results with Velocity Banking varies depending on individual circumstances, including the amount of debt, income level, and repayment strategy. With diligent implementation of Velocity Banking principles, individuals may start to see significant progress within months.

- Are there any risks associated with Velocity Banking?

- While Velocity Banking offers potential benefits, it also entails certain risks, including overleveraging, interest rate fluctuations, and liquidity constraints. It is crucial to exercise caution and maintain financial discipline when implementing Velocity Banking.

- Can Velocity Banking be combined with other financial strategies?

- Yes, Velocity Banking can be complemented by other financial strategies such as budgeting, saving, and investing. Integrating multiple financial approaches can enhance overall financial wellness and accelerate progress towards long-term financial goals.