What is Scarcity in Economics

Scarcity is a fundamental concept in economics that refers to the limited availability of resources compared to the unlimited wants and needs of individuals and society. In essence, it is the condition where human wants exceed the resources available to fulfill those wants. This article will delve deeper into the concept of scarcity, its key components, types, impact, strategies to address it, examples, and future trends.

Key Concepts in Scarcity

Supply and Demand

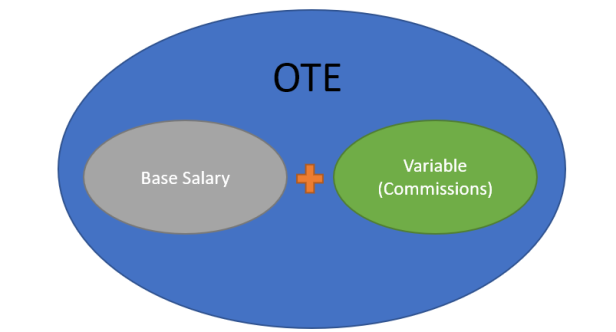

At the core of scarcity lies the interplay between supply and demand. When resources are scarce, their demand tends to exceed their supply, leading to competition among individuals or entities to acquire them. This competition often drives up prices as individuals are willing to pay more to obtain the limited resources. Also, read about What is Ote in Sales

Opportunity Cost

Another crucial concept related to scarcity is opportunity cost. As resources are limited, choosing to allocate them to one use implies forgoing the opportunity to allocate them to another. Thus, every decision involves trade-offs, and individuals must weigh the benefits of each option against the costs, considering what they are giving up.

Factors Contributing to Scarcity

Several factors contribute to the existence of scarcity. These include the finite nature of resources, population growth, technological limitations, distribution inequalities, and environmental degradation. Each of these factors exacerbates the gap between wants and resources, perpetuating the condition of scarcity.

Types of Scarcity

Natural Resources Scarcity

Natural resources, such as water, land, minerals, and fossil fuels, are finite and subject to depletion. As population grows and industrialization advances, the demand for these resources increases, leading to concerns about their scarcity.

Human Resources Scarcity

Human resources, including skilled labor, knowledge, and expertise, can also become scarce. This scarcity may arise due to factors such as inadequate education and training, demographic shifts, or mismatches between available skills and market demand.

Capital Scarcity

Capital, in the form of financial resources, machinery, infrastructure, and technology, can be scarce as well. Limited access to capital can hinder economic growth and development, particularly in emerging economies or for small businesses with constrained financing options. Discover more about What is Economy Value

Impact of Scarcity

Price Determination

Scarcity plays a crucial role in determining prices in markets. When resources are scarce, their prices tend to rise as demand outstrips supply. Conversely, when resources are abundant, prices may decrease due to lower demand relative to supply.

Allocation of Resources

Scarcity necessitates choices regarding the allocation of resources. Individuals, businesses, and governments must prioritize how to utilize limited resources efficiently to meet their most pressing needs and maximize societal welfare.

Economic Decision-Making

Scarcity influences economic decision-making at all levels. Individuals make choices about how to allocate their time and money, firms decide which goods and services to produce, and governments implement policies to address resource allocation and distribution.

Strategies to Address Scarcity

Innovation and Technology

Innovation and technological advancements can help mitigate scarcity by increasing resource efficiency, developing alternative sources of energy, and enhancing productivity. Investments in research and development contribute to finding solutions to scarcity challenges.

Conservation and Sustainability

Conservation efforts and sustainable practices aim to preserve natural resources for future generations. Measures such as recycling, renewable energy adoption, and ecosystem protection contribute to reducing resource depletion and environmental degradation.

Government Intervention

Government intervention through regulations, subsidies, and taxation can influence resource allocation and address market failures stemming from scarcity. Policies promoting fair competition, environmental protection, and social welfare can help mitigate the adverse effects of scarcity.

Examples of Scarcity

Water Scarcity

Water scarcity is a pressing global issue affecting millions of people worldwide. Population growth, climate change, pollution, and inefficient water management exacerbate the scarcity of clean and accessible water, leading to social, economic, and environmental challenges.

Oil Scarcity

The finite nature of fossil fuels, particularly oil, poses challenges to energy security and sustainability. As demand for energy continues to rise, concerns about oil scarcity, price volatility, and geopolitical tensions surrounding oil-producing regions persist.

Labor Scarcity

Labor scarcity occurs when there is a mismatch between the skills demanded by employers and those available in the workforce. This phenomenon can lead to labor shortages in key industries, hinder economic growth, and exacerbate income inequality.

Future Trends in Scarcity

Population Growth

The world’s population is projected to continue growing, placing additional strain on finite resources and exacerbating scarcity challenges. Addressing population growth through education, healthcare, and family planning initiatives is crucial for sustainable resource management.

Technological Advancements

Advancements in technology, such as artificial intelligence, biotechnology, and renewable energy, hold promise for addressing scarcity by enhancing resource efficiency, creating new sources of energy, and improving productivity.

Environmental Concerns

Environmental degradation, including climate change, deforestation, and biodiversity loss, poses significant threats to global resources. Addressing these concerns through sustainable practices and conservation efforts is essential for mitigating scarcity and preserving the planet’s ecosystems.

Conclusion

In conclusion, scarcity is a fundamental economic concept that arises from the imbalance between unlimited wants and limited resources. Understanding the causes, impacts, and strategies to address scarcity is crucial for promoting sustainable development and ensuring the well-being of present and future generations.

FAQs

Why is scarcity considered a fundamental concept in economics?

Scarcity underscores the need for choices and trade-offs in resource allocation, influencing economic decision-making.

How does scarcity affect prices in markets?

Scarcity often leads to higher prices as demand exceeds supply, reflecting the relative scarcity of resources.

What are some examples of government intervention to address scarcity?

Government intervention may include regulations to protect natural resources, subsidies for renewable energy, and taxation to internalize externalities.

How can individuals contribute to addressing scarcity?

Individuals can adopt sustainable practices, support conservation efforts, and advocate for policies that promote resource efficiency and environmental protection.

What role does technology play in addressing scarcity?

Technology can help mitigate scarcity by improving resource efficiency, developing alternative sources of energy, and enhancing productivity.