2 hours ago

Latest Updates

Featured Posts

Get in Touch

Location:

123 Innovation Street

Tech District, CA 94105

123 Innovation Street

Tech District, CA 94105

Email:

[email protected]

[email protected]

Phone:

+1 (234) 567-890

+1 (234) 567-890

What is a General Ledger? Ultimate Guide

What is a General Ledger

A general ledger is a core component of a company's accounting system, used for tracking and recording all financial transactions. It serves as a central repository for all the company's financial information and plays a fundamental role in the financial reporting and management of an organization. Here are key aspects of a general ledger: Record-Keeping: The general ledger is used to record all financial transactions, such as sales, purchases, expenses, and various other financial activities. Each transaction is documented in a specific account within the ledger. Double-Entry Accounting: The general ledger employs double-entry accounting, which means that for every financial transaction, there are at least two entries: a debit and a credit. This ensures that the ledger remains in balance. Chart of Accounts: A chart of accounts is a structured list of all the accounts used in the general ledger. Accounts are categorized and organized to reflect the company's financial structure. Common account categories include assets, liabilities, equity, revenue, and expenses. Posting Transactions: Once a financial transaction occurs, the details are entered into the appropriate accounts in the general ledger. Debits and credits are used to reflect increases or decreases in account balances. Trial Balance: Periodically, account balances are summarized in a trial balance to ensure that the total debits and credits in the ledger are in balance. If they are not equal, it indicates an error that needs correction. Financial Statements: The data stored in the general ledger is used to prepare various financial statements, including the balance sheet, income statement, and cash flow statement. These statements are essential for reporting the company's financial performance and position. Audit Trail: The general ledger provides a comprehensive audit trail, allowing financial transactions to be traced and verified. This is crucial for internal and external auditing, as it supports transparency and accountability. Historical Record: The general ledger serves as a historical record of financial activities, making it possible to analyze past performance and trends, which is vital for decision-making and planning. Software and Technology: In modern accounting, general ledgers are often managed through accounting software and Enterprise Resource Planning (ERP) systems, which automate many aspects of transaction recording and reporting. Reconciliation: Reconciliation is the process of comparing the balances in the general ledger to those in subsidiary ledgers or external records, ensuring that they match and are accurate. https://www.youtube.com/watch?v=Wda0K93Nk0c&pp=ygUYd2hhdCBpcyBhIGdlbmVyYWwgbGVkZ2VyImportance of a General Ledger

The importance of a general ledger cannot be overstated. It serves as the foundation for all financial reporting, making it an essential tool for decision-making, auditing, and compliance. Without an accurate and up-to-date general ledger, a business would be navigating in the dark, financially speaking. Don't forget to visit our website globallbrowse.comComponents of a General Ledger

Chart of Accounts

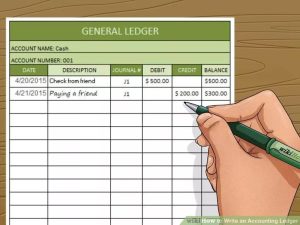

A crucial element of the general ledger is the chart of accounts. This is a list of all accounts a business uses to record its financial transactions. Each account is assigned a unique code and description for easy reference.Journal Entries

Journal entries are the individual transactions that are recorded in the general ledger. They are like the building blocks that make up the ledger. Each journal entry contains the date, description, and the amount of the transaction.Debits and Credits

Debits and credits are the language of accounting. Debits represent money going out of an account, while credits represent money coming into an account. Understanding this fundamental concept is key to maintaining a balanced ledger.How General Ledgers are Used

Tracking Financial Transactions

One of the primary functions of a general ledger is to track financial transactions. It provides a detailed history of all money movements within a business, making it easier to spot trends and anomalies.Preparing Financial Statements

The data from the general ledger is used to prepare financial statements such as the balance sheet, income statement, and cash flow statement. These statements are critical for evaluating a company's financial performance.Auditing and Compliance

General ledgers play a vital role in auditing and ensuring compliance with accounting standards and regulations. An accurate ledger simplifies the audit process and helps businesses meet legal requirements. [caption id="attachment_137" align="aligncenter" width="300"] How General Ledgers are Used[/caption]

How General Ledgers are Used[/caption]